EMPLOYER || CANDIDATE

EMPLOYER || CANDIDATE

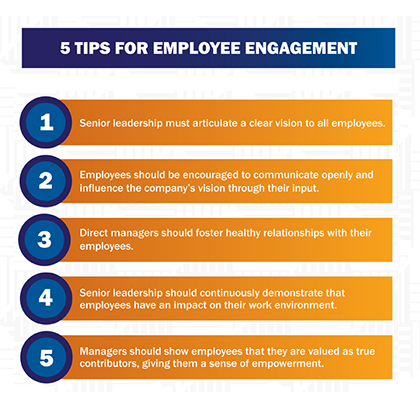

HR Planning

Employer

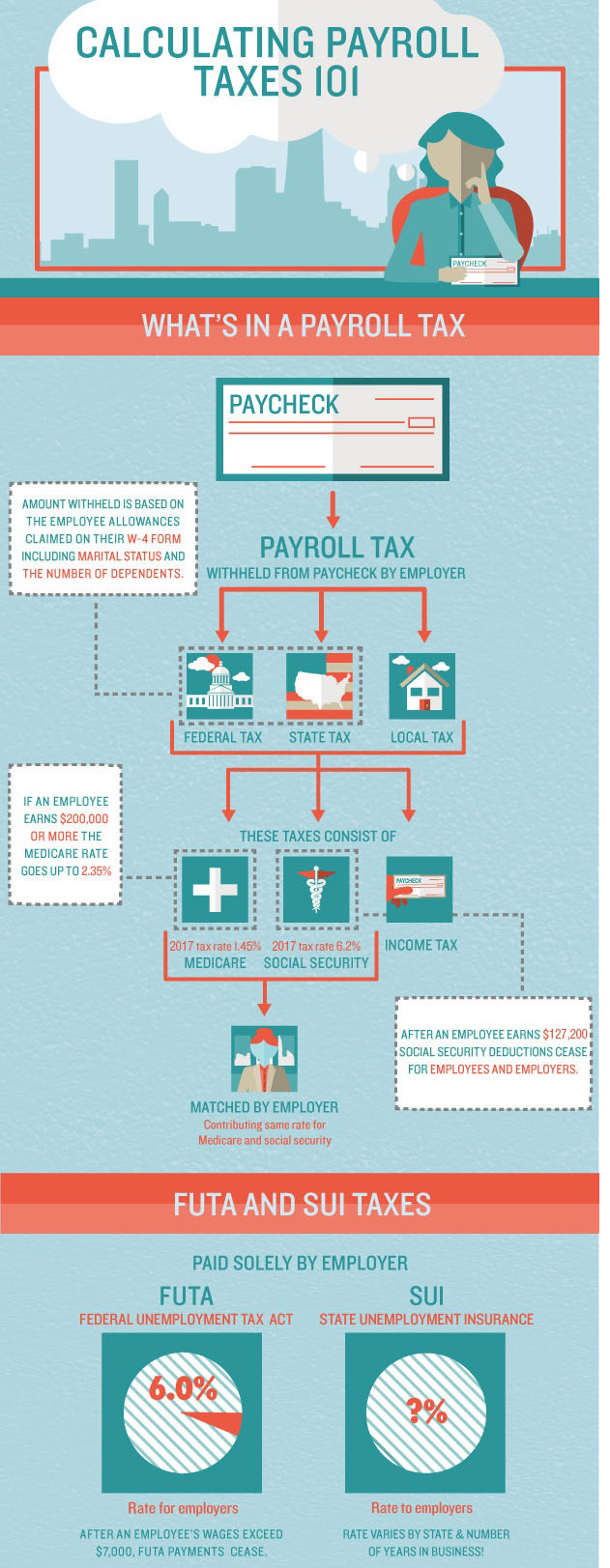

Business & Payroll Taxes

Business & Payroll Taxes

What Are Payroll Taxes?

State taxes aside, navigating federal payroll taxes can feel a bit like navigating a minefield. One wrong step and - boom! you're in trouble with the IRS.

It's always a best practice to check with your accountant when it comes to calculating payroll taxes (or anything to do with numbers), but you can get a pretty accurate estimate by following these steps.

The Federal Unemployment Tax Act (FUTA) sets your unemployment tax rate per employee at 6 percent, but if you qualify, you can claim a 5.4 percent credit. That would make your FUTA tax rate .6 percent.

However, once an employee's year-to-date earnings surpass $7,000, you no longer have to pay the FUTA federal unemployment tax on that employee for the remainder of the year.

What is your federal unemployment (FUTA) tax rate?

While you should always check with your accountant to know where you stand, businesses that file the Form 940, or the Employer's Annual Federal Unemployment (FUTA) Tax Return, typically qualify for the 5.4 percent credit.

For more information, see the IRS FUTA Credit Reduction Guide.

What is your Social Security (FICA) tax rate?

Social Security tax is 6.2 percent of the taxable wages paid to each employee each year (up to $127,200 for 2017, a number that changes annually).

What is your Medicare (FICA) tax rate?

Medicare tax is 1.45 percent of all taxable wages paid to each employee, with an additional .9 percent tax rate on wages that exceed $200,000.

What is your state's unemployment tax rate?

This rate (and the annual wage limit) is determined for you by your state unemployment agency. Some state unemployment tax rate minimums are as low as 0.0%, as is the case in places like Hawaii, Iowa, Mississippi, Missouri, Montana, Nebraska, and South Dakota.

Meanwhile, maximum tax rates can be as high as 12 percent, as is the case in Wisconsin. Always check with your accountant if you're not sure where you stand.

What is your employment or job-training tax rate?

Some states require employers to pay employment or job-training taxes. If you're not sure whether or not your state is one of them, check with your accountant.